Investing is a key step toward financial independence — but where to put your money often poses a dilemma. Should you choose Real Estate vs Gold Nagpur or mutual funds? Each asset class has unique benefits and risks. In this blog, we break down this comparison and answer: Is buying a plot in Nagpur a better investment than mutual funds or gold? Let’s explore.

Why People Compare Real Estate, Gold, and Mutual Funds

Before comparing, it’s important to understand why these three options are popular:

- Real Estate: Tangible asset with appreciation plus rental or resale opportunity.

- Gold: Traditional safe-haven asset, often used as inflation protection.

- Mutual Funds: Market-linked financial investment with professional management.

Historically, all three asset classes serve specific purposes depending on investor preferences, risk tolerance, and timeline.

1. Real Estate in Nagpur: The Tangible Growth Story Real Estate vs Gold Nagpur

Why Nagpur Real Estate Is Gaining Attention

Nagpur, a tier-2 city in central India, is emerging as an investment hub due to infrastructure expansion and economic growth drivers like MIHAN (Multi-modal International Cargo Hub and Airport). Improved connectivity, expressways, and business district plans attract both homebuyers and investors.

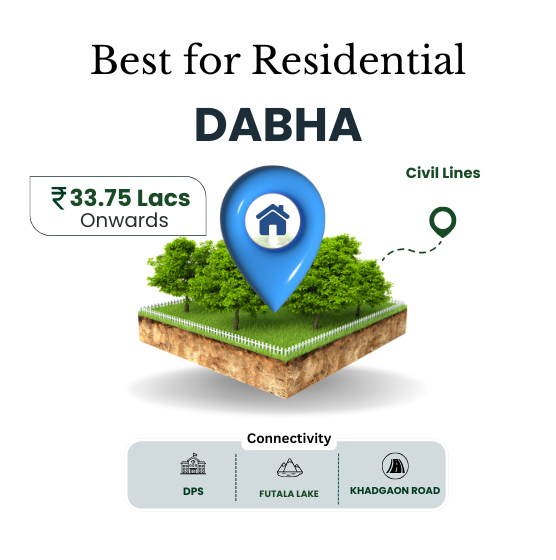

Data on Nagpur plot prices indicates strong momentum in key corridors like Wardha Road, Somalwada, Hingna, and Dabha, with substantial transaction activity and rising valuations.

Appreciation & ROI

Recent market data shows plots in strategic locations delivering an annual appreciation of 8–15%, with prime corridors posting 35–58% reward over recent years.

These figures demonstrate that land in Nagpur doesn’t just serve as shelter; it can act as a serious wealth-building asset — particularly with long-term holding and demand from end-users and developers.

The Real Estate Advantage

Tangible Asset:

Plots are physical assets — they can’t vanish like market value.

Dual Return Potential:

You gain capital appreciation and rental or resale revenue — unlike gold, which generates no income.

Inflation Hedge:

Real estate often keeps pace with or beats inflation due to rising construction and land value.

2. Gold: Safe-Haven But Income-Free

Gold is a deeply rooted investment preference in India, prized for stability and traditional value.

However, gold has limitations:

- It doesn’t generate cash flow (no rent or dividends).

- Returns vary with global trends and may fall short during stable market conditions.

- While historically offering 8–13% p.a., gold’s performance can lag over long periods compared with equities.

Gold performs best during market crises, but it should usually be a part of a diversified portfolio rather than a standalone long-term growth strategy.

3. Mutual Funds: Growth Through Markets

Mutual funds pool investor money to invest in stocks, bonds, or mixed assets, managed by professionals. They offer:

- Higher returns historically — equity mutual funds often deliver 10–15% or more annually.

- High liquidity: You can sell your units quickly when needed.

- Ease of entry: Start with small amounts via SIPs and compound returns over time.

While market risk is higher than gold or property, the long-term growth of mutual funds has outpaced inflation and traditional assets when held with discipline.

Direct Comparison: Real Estate vs Gold Nagpur vs Mutual Funds

| Factor | Real Estate (Nagpur Plots) | Gold | Mutual Funds |

|---|---|---|---|

| Returns | 8–15%+ p.a. in prime areas | 8–13% (variable) | 10–15%+ (long term) |

| Liquidity | Low | High | High |

| Income Generation | Yes (rent/resale) | No | Yes (when dividends are declared) |

| Risk Level | Moderate | Low | Moderate–High |

| Inflation Hedge | Strong | Strong | Variable |

| Diversification Role | Anchor asset | Safe branding | Growth engine |

How to Choose: Your Investment Goals

If You Are Looking for Stability + Tangible Asset

Nagpur plots can be powerful long-term assets that combine lifestyle utility with investment appreciation — especially in growth corridors.

If You Prioritize Liquidity and Flexibility

Mutual funds, with their ease of entry and exit plus potential higher returns through compounding, may fit better. Real Estate vs Gold Nagpur

If Your Focus is a Safe Save-Asset

Gold offers peace of mind during uncertain times but should ideally occupy just a small portion of your portfolio.

Conclusion

Is buying a plot in Nagpur better than mutual funds or gold?

It depends on your investment horizon, risk appetite, and financial goals:

- For long-term capital appreciation plus utility and income, buying a plot in Nagpur can outperform gold and be competitive with mutual funds in the right locations. Real Estate vs Gold Nagpur

- For liquidity and market-linked growth, mutual funds often deliver higher returns over extended periods.

- For crisis buffering and tradition, gold remains relevant as part of diversification.

Best practice: Build a balanced portfolio that leverages the strengths of all three — land as an anchor asset, mutual funds for growth, and gold as a hedge. Diversification helps minimize risk while maximizing returns over various market cycles.

Bhumesh Realtors

Trusted real estate company in Nagpur since 2018, offering NMRDA & RERA approved plots with up to 90% bank loan assistance. Over 3,000+ plots sold across prime Wardha Road locations.

Address: 4 th Floor, Lusin Tower, beside Hotel Travotel, Wardha Road Nagpur, 440015

Phone: +0712 2222712 +919370159082

Website: https://bhumeshrealtors.com/

Email: digital.bhumesh@gmail.com contact@bhumeshrealtors.com

You tube link: https://www.youtube.com/@bhumeshrealtors5206

Instagram : https://www.instagram.com/bhumesh_realtors/

Twitter : https://x.com/BhumeshRealtors

Facebook : https://www.facebook.com/bhumeshrealtors/

Linked in : https://www.linkedin.com/company/bhumesh-realtors/

BHUMESH REALTORS

4th Floor, Lusin Tower Beside Hotel Travotel, Wardha Road Nagpur 440015

Google – https://maps.app.goo.gl/1BphiupWEPJsidF67