Applying for a home loan is often the first step toward owning your dream home. But before a bank hands over the keys to your future, you must meet their eligibility requirements. This home loan eligibility checklist will help you understand exactly what financial institutions look for — and how to improve your chances of approval.

At Bhumesh Realtors, we guide every client through the home-buying process, including financial planning and loan eligibility.

📋 Why Is a Home Loan Eligibility Checklist Important?

Knowing your home loan eligibility in advance:

- Saves time and effort

- Increases approval chances

- Helps you plan your budget better

- Prevents rejection due to missing documents or poor credit history

Let’s break down the key factors banks evaluate before sanctioning a loan. home loan eligibility checklist

✅ 1. Age of the Applicant

- Most banks prefer applicants aged 21 to 60 years.

- Younger applicants get longer tenures, which can reduce EMI burden.

- Older applicants may face restrictions on the loan term.

✅ 2. Monthly Income

- Salaried individuals must have a minimum income (usually ₹25,000–₹30,000/month) depending on the city.

- Self-employed professionals must show stable income through ITRs (Income Tax Returns) and bank statements.

💡 Tip from Bhumesh Realtors: Banks usually allow EMIs up to 40–50% of your monthly income.

✅ 3. Credit Score

- A CIBIL score of 750 or above is ideal.

- Lower scores may lead to rejection or higher interest rates.

- Always check your credit report before applying.

✅ 4. Employment Type & Stability

- Salaried: Preferably with a reputed company or government job.

- Self-employed: Minimum 2-3 years of consistent business income.

Stability is key. Frequent job changes or irregular income may raise red flags.

✅ 5. Loan Amount & Property Value

- Banks typically fund up to 75-90% of the property value.

- The remaining amount (down payment) must come from your own funds.

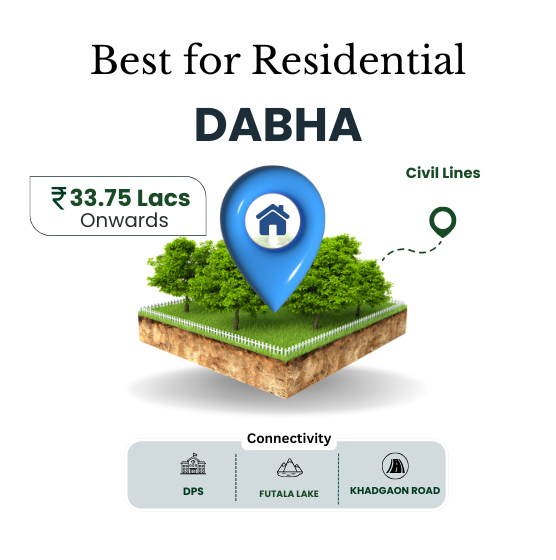

Bhumesh Realtors can help you find properties that fit your budget and loan eligibility — making approval smoother and faster.

✅ 6. Existing Financial Obligations

- Ongoing loans (personal, car, credit cards) impact your eligibility.

- A high debt-to-income ratio reduces loan sanction chances.

Keep your monthly commitments in check.

✅ 7. Co-Applicant (Optional but Helpful)

- Adding a co-applicant (spouse or parent) with good credit and income can increase eligibility.

- Co-ownership of the property is usually required.

📂 Essential Documents Checklist

- PAN card and Aadhaar card

- Salary slips (last 3 months) or ITR (for self-employed)

- Bank statements (last 6 months)

- Form 16 or employment letter

- Property documents

🏢 How Bhumesh Realtors Can Help

At Bhumesh Realtors, we:

- Connect you with trusted banking partners

- Pre-screen your home loan eligibility

- Help you arrange required documents

- Suggest properties that match your financial profile

🧮 Quick Eligibility Formula

Loan Eligibility = (Net Monthly Income x 0.5) x Loan Tenure (in months)

Adjusted for age, credit score, and interest rate.

Use online eligibility calculators or reach out to our team for a personalized assessment.

🔚 Final Words: Plan Smart, Buy Confidently

Following this home loan eligibility checklist will make your journey to homeownership faster and stress-free. Preparation is the key to approval — and peace of mind.

Bhumesh Realtors is always here to support your home-buying goals from property selection to loan application.

Comments are closed